Most of the people working in IT care about services they provide, Service Level Agreements (SLAs), vendors, suppliers, technology… but, there are always a lot of questions concerning financial issues of the IT services. How much does our service cost? Why exactly that much? How much are we spending? How much are we allowed to spend?

Theory…

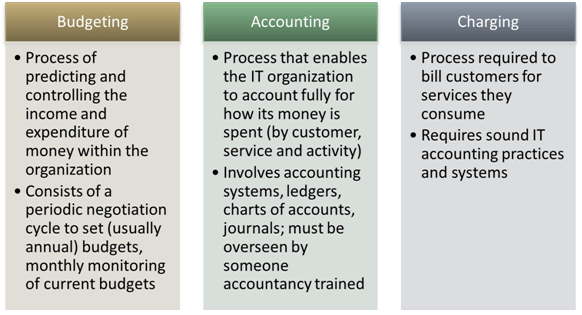

Let’s explain foundations. Financial management for IT services is a process inside the Service Strategy phase of an ITIL IT Service Lifecycle. It consists of three main processes:

Budgeting – this process plans income and expenditure of money for an organization. Planning is done periodically (usually once a year). Planning is important because it decreases risk of over-spending in the future. The same process controls income and costs incurred on a monthly basis. This means that monthly income and monthly costs will be monitored and compared with budgeted (i.e. planned) funds. Based on that information, measures can be taken to implement corrections that will keep the budget on track.

Accounting – this process enables an IT organization to account for the way its money is spent. This particularly refers to identification of costs by customer, by service or by activity. For example, accounting will answer the question “How much does e-mail service (per mailbox) cost?” Someone who pays the bill (internal or external customer) wants to know the answer. To answer such a question, IT financial management has to know of which cost-item e-mail service is build (e.g. hardware, software, people, etc.).

An efficient accounting process increases IT service provision and defines areas where cost savings can be made (i.e. financial efficiency). There are several cost elements that accounting uses:

- Capital Costs (or capital expenditure – CAPEX) – cost of purchasing something that will become a financial asset, e.g. server.

- Operational Costs (or operational expenditure – OPEX) – cost incurred from running the services, e.g. electricity invoices, salary… Depending on organization’s (financial) strategy, CAPEX and OPEX can be governed. Cloud services are an example. Organization can shift capital expenditure (investing in own data centre infrastructure) to operational expenditure (monthly fee for resources required) by using cloud services instead of its own.

- Direct Costs – costs that can be directly applied to a certain service or customer, e.g. purchase of a server that will be used for one particular service.

- Indirect Costs – costs that cannot be directly allocated to a particular service or customer, e.g. SW licence for server which runs several applications or serves several customers.

- Fixed Costs – costs that don’t change with IT service usage or in the short-term, e.g. annual lease contract.

- Variable Costs – costs that vary in the short-term depending how much service is used, e.g. energy consumed to run servers.

Charging is the activity whereby payment is required for services delivered. Charging requires that accounting procedures and systems exist and are set up. It makes a difference whether the organization is an internal service provider, or if it serves external customer as its main business. In the case where an IT organization is an internal service provider (according to ITIL, these are Type I and Type II organizations), it is not necessary to bill for services. Sometimes such IT organizations only allocate costs. If an IT organization sells its services to external customers (Type III organization) they will, certainly, issue bills for their services and generate income which funds that organization.

Figure: Processes of Financial Management for IT services

Figure: Processes of Financial Management for IT services

… And Practice

Praxis is defined by many parameters depending on type and structure of an organization, business model, IT governance model, management… I will mention just some of them.

Budgeting, as a cross-department process, usually belongs to the financial department or CFO. IT contributes for services, resources and costs. It occurs once a year and usually includes the running business year, the next year and even more. I know that it is hard to know what will happen in the next, say, two years; but, even so, budgeting for the next few years defines the strategic development of an organization.

Accounting is a process that can be highly complex. There are some costs that are easily identifiable, but there are some costs that are usually approximated. Let’s take Service Desk resources as an example (people, technology, fixed costs). It is (usually) good enough for people working at the Service Desk to estimate time they spend on a certain service, rather than counting every minute of their activity. What I found out is that people who are paying the bills (valid for both internal as well as external customers) wants to know the structure of the costs that they are paying for. Therefore, it is crucial to have the most detailed cost structure possible for services that are billed.

Charging for services by an organization with external customers is the only way to get funding for the organization, cover costs and generate revenue. But, in the case of an internal service provider it can be seen as bureaucratic procedure, which is true. On the other side, I found that internal charging has several advantages:

- It justifies IT resources needed (increased transparency),

- users throughout organization use only resources they really need (optimization of usage),

- business can plan their cost of operation (which is, further on, included in price charged to their customers), and

- IT has better control of its business.

Although not beloved by IT staff, IT Financial Management is a foundation process for an (IT) organization to plan, control and run its business. It influences or is integrated in most of the other IT Service Lifecycle phases and has high visibility outside the IT organization; and, therefore, mistakes in implementation (including not implementing Financial Management) can be very expensive.

Learn more about the Financial Management process from this free template.

Branimir Valentic

Branimir Valentic