Rhand Leal

Rhand Leal

September 29, 2020

Implementation, maintenance, training, and knowledge products for Information Security Management Systems (ISMS) according to the ISO 27001 standard.

Automate your ISMS implementation and maintenance with the Risk Register, Statement of Applicability, and wizards for all required documents.

All required policies, procedures, and forms to implement an ISMS according to ISO 27001.

Train your key people about ISO 27001 requirements and provide cybersecurity awareness training to all of your employees.

Accredited courses for individuals and security professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 and the ISMS using Advisera’s proprietary AI-powered knowledge base.

Compliance and training products for critical infrastructure organizations for the European Union’s Network and Information Systems cybersecurity directive.

All required policies, procedures, and forms to comply with the NIS 2 cybersecurity directive.

Company-wide training program for employees and senior management to comply with Article 20 of the NIS 2 cybersecurity directive.

Compliance and training products for financial entities for the European Union’s DORA regulation.

All required policies, procedures, and forms to comply with the DORA regulation.

Company-wide cybersecurity and resilience training program for all employees, to train them and raise awareness about ICT risk management.

Accredited courses for individuals and DORA professionals who want the highest-quality training and certification.

Training products for Artificial Intelligence Management Systems (AIMS) and AI governance according to the ISO 42001 standard.

Accredited courses for individuals, consultants, and AI professionals who want the highest-quality training and certification in AI governance and compliance.

Train your key people on ISO 42001 requirements and provide company-wide AI governance training so employees learn how to use AI responsibly and in compliance with your policies.

Compliance and training products for personal data protection according to the European Union’s General Data Protection Regulation.

All required policies, procedures, and forms to comply with the EU GDPR privacy regulation.

Train your key people about GDPR requirements to ensure awareness of data protection principles, privacy rights, and regulatory compliance.

Accredited courses for individuals and privacy professionals who want the highest-quality training and certification.

Implementation, training, and knowledge products for Quality Management Systems (QMS) according to the ISO 9001 standard.

All required policies, procedures, and forms to implement a QMS according to ISO 9001.

Accredited courses for individuals and quality professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 9001 and the QMS using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for Environmental Management Systems (EMS) according to the ISO 14001 standard.

All required policies, procedures, and forms to implement an EMS according to ISO 14001.

Accredited courses for individuals and environmental professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 14001 and the EMS using Advisera’s proprietary AI-powered knowledge base.

Implementation and training products for Occupational Health & Safety Management Systems (OHSMS) according to the ISO 45001 standard.

All required policies, procedures, and forms to implement an OHSMS according to ISO 45001.

Accredited courses for individuals and health & safety professionals who want the highest-quality training and certification.

Implementation and training products for medical device Quality Management Systems (QMS) according to the ISO 13485 standard.

All required policies, procedures, and forms to implement a medical device QMS according to ISO 13485.

Accredited courses for individuals and medical device professionals who want the highest-quality training and certification.

Compliance products for the European Union’s Medical Device Regulation.

All required policies, procedures, and forms to comply with the EU MDR.

Implementation products for Information Technology Service Management Systems (ITSMS) according to the ISO 20000 standard.

All required policies, procedures, and forms to implement an ITSMS according to ISO 20000.

Implementation products for Business Continuity Management Systems (BCMS) according to the ISO 22301 standard.

All required policies, procedures, and forms to implement a BCMS according to ISO 22301.

Implementation products for testing and calibration laboratories according to the ISO 17025 standard.

All required policies, procedures, and forms to implement ISO 17025 in a laboratory.

Implementation products for automotive Quality Management Systems (QMS) according to the IATF 16949 standard.

All required policies, procedures, and forms to implement an automotive QMS according to IATF 16949.

Implementation products for aerospace Quality Management Systems (QMS) according to the AS9100 standard.

All required policies, procedures, and forms to implement an aerospace QMS according to AS9100.

Implementation, maintenance, training, and knowledge products for consultancies.

Handle multiple ISO 27001 projects by automating repetitive tasks during ISMS implementation.

All required policies, procedures, and forms to implement various standards and regulations for your clients.

Grow your business by organizing cybersecurity and compliance training for your clients under your own brand using Advisera’s learning management system platform.

Accredited Lead Auditor and Lead Implementer courses for ISO standards and DORA, and an advanced course to help consultants grow their business.

Get instant answers to any questions related to ISO 27001 (ISMS), ISO 9001 (QMS), and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Find new clients, potential partners, and collaborators and meet a community of like-minded professionals locally and globally.

Implementation, maintenance, training, and knowledge products for the IT industry.

Automate your ISMS implementation and maintenance with the Risk Register, Statement of Applicability, and wizards for all required documents.

Documentation to comply with ISO 27001 (cybersecurity), ISO 22301 (business continuity), ISO 20000 (IT service management), GDPR (privacy), NIS 2 (critical infrastructure cybersecurity), and DORA (cybersecurity for financial sector).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity, privacy, and AI program.

Accredited courses for individuals and security professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 and the ISMS using Advisera’s proprietary AI-powered knowledge base.

Compliance, training, and knowledge products for essential and important organizations.

Documentation to comply with NIS 2 (cybersecurity), GDPR (privacy), ISO 27001 (cybersecurity), and ISO 22301 (business continuity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and security professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 and the ISMS using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for manufacturing companies.

Documentation to comply with ISO 9001 (quality), ISO 14001 (environmental), and ISO 45001 (health & safety), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 9001 (QMS) and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for transportation & distribution companies.

Documentation to comply with ISO 9001 (quality), ISO 14001 (environmental), and ISO 45001 (health & safety), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 9001 (QMS) and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for schools, universities, and other educational organizations.

Documentation to comply with ISO 27001 (cybersecurity), ISO 9001 (quality), and GDPR (privacy).

Company-wide cybersecurity and AI governance awareness program for all employees, to decrease incidents, support a successful cybersecurity program, and ensure responsible use of AI.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 (ISMS) and ISO 9001 (QMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, maintenance, training, and knowledge products for telecoms.

Automate your ISMS implementation and maintenance with the Risk Register, Statement of Applicability, and wizards for all required documents.

Documentation to comply with ISO 27001 (cybersecurity), ISO 22301 (business continuity), ISO 20000 (IT service management), GDPR (privacy), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and security professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 and the ISMS using Advisera’s proprietary AI-powered knowledge base.

Implementation, maintenance, training, and knowledge products for banks, insurance companies, and other financial organizations.

Automate your ISMS implementation and maintenance with the Risk Register, Statement of Applicability, and wizards for all required documents.

Documentation to comply with DORA (cybersecurity for financial sector), ISO 27001 (cybersecurity), ISO 22301 (business continuity), and GDPR (privacy).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity, privacy, and AI program.

Accredited courses for individuals and security professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 and the ISMS using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for local, regional, and national government entities.

Documentation to comply with ISO 27001 (cybersecurity), ISO 9001 (quality), GDPR (privacy), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity, privacy, and AI program.

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity, privacy, and AI program.

Get instant answers to any questions related to ISO 27001 (ISMS) and ISO 9001 (QMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for hospitals and other health organizations.

Documentation to comply with ISO 27001 (cybersecurity), ISO 9001 (quality), ISO 14001 (environmental), ISO 45001 (health & safety), NIS 2 (critical infrastructure cybersecurity) and GDPR (privacy).

Company-wide cybersecurity and AI governance awareness program for all employees, to decrease incidents, support a successful cybersecurity program, and ensure responsible use of AI.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 (ISMS), ISO 9001 (QMS), and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for the medical device industry.

Documentation to comply with MDR and ISO 13485 (medical device), ISO 27001 (cybersecurity), ISO 9001 (quality), ISO 14001 (environmental), ISO 45001 (health & safety), NIS 2 (critical infrastructure cybersecurity) and GDPR (privacy).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity, privacy, and AI program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 (ISMS), ISO 9001 (QMS), and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for the aerospace industry.

Documentation to comply with AS9100 (aerospace), ISO 9001 (quality), ISO 14001 (environmental), and ISO 45001 (health & safety), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 9001 (QMS) and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for the automotive industry.

Documentation to comply with IATF 16949 (automotive), ISO 9001 (quality), ISO 14001 (environmental), and ISO 45001 (health & safety), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity and AI program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 9001 (QMS) and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for laboratories.

Documentation to comply with ISO 17025 (testing and calibration laboratories), ISO 9001 (quality), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and quality professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 9001 and the QMS using Advisera’s proprietary AI-powered knowledge base.

Rhand Leal

Rhand Leal

Think of a circus juggler balancing dishes, bowls, and other flat objects on sticks. He needs to pay constant attention so as not to let them fall, rotating them at sufficient speed and at the right time.

This situation is similar to managing investments in security, where the juggler is the organization, the rotating objects are the risks, and the action of rotating them refers to the resources invested.

By understanding the rotating dishes situation, the equivalent of analyzing the risks, the juggler can decide on the order in which he needs to work on them, and the necessary speed to apply to each one of them, so none of them fall (i.e., the risks do not occur).

In this article, we will use the juggler analogy, and how he keeps the objects rotating, to explain how to prioritize risks through risk quantification.

This first analogy leads us to some of the benefits of security investment prioritization:

– more efficient allocation of people, processes, and budget: prioritization helps organizations to invest only the needed resources required to handle risks – no more, no less.

– increased focus around the risks that matter most: prioritization gives employees guidance on what the organization sees as important.

– increased success rate: with risks treated according to their criticality, the chance of their occurrence is lessened, as well as their chance of negatively impacting the organization’s objectives and expected outcomes.

First, it is important to note that risk value can be expressed in qualitative or quantitative form.

In the qualitative form, risks are valued based on the perceptions of those analyzing them, and perceptions can be biased, which makes it difficult to use them outside the context in which they were analyzed.

On the other hand, when we talk about risk quantification, we mean defining the value of risk based on verifiable data and calculations, and this is important because it allows verification, comparison, and reduction of the bias effect. That’s why quantitative risk is often used when defining security investment.

Returning to our analogy, balancing objects on sticks is basically the application of physics (the gyroscopic effect), which involves rotation speed and direction, regardless of the object used. By analyzing both speed and direction of objects, the juggler is able to balance any kind of object.

The ISO definition for risk according to the ISO Guide 73, which defines the vocabulary for risk management, is: “the effect of uncertainty on objectives.”

Considering that, the variables most used to quantify risks are likelihood and impact. Normally, quantified risk is expressed in monetary values, as it facilitates understanding of a specific risk by the whole organization, and because it makes the evaluation of the required security investment quicker.

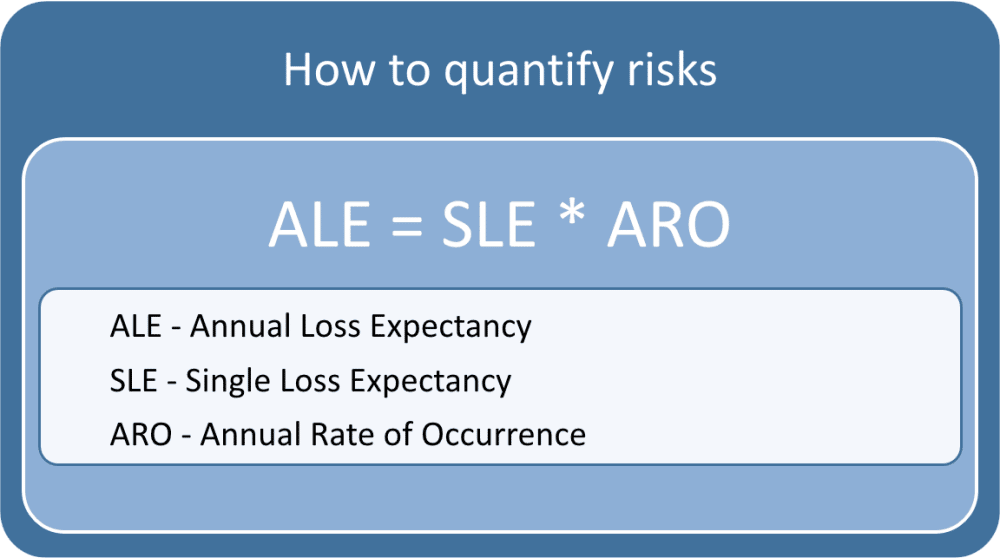

To reach a monetary result, quantitative risk assessment often makes use of these concepts:

SLE (Single Loss Expectancy): money expected to be lost if the incident occurs one time.

ARO (Annual Rate of Occurrence): how many times in a one-year interval the incident is expected to occur.

ALE (Annual Loss Expectancy): money expected to be lost in one year considering SLE and ARO (ALE = SLE * ARO). For quantitative risk assessment, this is the risk value.

Below is an example of how risk values are calculated through quantitative risk assessment:

Database value: USD 2.5 million (SLE)

Manufacturer statistics inform that a database catastrophic failure (due to software or hardware) occurs one time every 10 years (ARO = 1/10 = 0.1).

ALE = 2.5 * 0.1 = USD 250K

In short, the organization has an annual risk of suffering a loss of USD 250K in the event of the loss of its database. So, any security investment that costs less than this value would be profitable.

When you perform this calculation for all the risks considered unacceptable by the organization, you will have a list containing the total expected security investment.

Although the use of quantified risks to prioritize security investment may seem quite straightforward, i.e., allocating resources to the higher risks, an organization also needs to take into account issues like:

– What is the sum of the values to be invested related to higher risks that have a higher probability of occurrence?

– What is the sum of the values to be invested related to lower risks that have a higher probability of occurrence?

– Is the return on security investment to be evaluated in the short, medium, or long term?

There is no correct answer for these questions because they will depend on the organization’s objectives and risk appetite. For example:

– If the security investment is to be evaluated in the short term, maybe there is no point in making big investments on higher risks with a low probability of occurring, and it is better to ensure that higher-probability risks are treated.

– If the security investment is to be evaluated in the long term, the sum of losses due to the occurrence of lower risks, even with implemented controls, may be acceptable, because preventing the higher risks will increase market confidence in the business, thereby increasing revenue.

Risk treatment is something organizations cannot postpone, because customers and society are becoming less and less accepting of those who do not treat risk properly.

On the other hand, the number of risks by far outweigh the available resources of any organization, so they need to search for ways to wisely invest their resources.

By understanding how risks affect the organization, and using proper data, quantifying risk can be of great use to drive security investments according to business objectives.

To learn how to implement ISO 27001 in the most cost-efficient way when compared to other solutions, and to save your employees time, sign up for a 14-day free trial of Conformio, the leading ISO 27001 compliance software.

Rhand Leal has more than 15 years of experience in information security, and for six years he continuously maintained а certified Information Security Management System based on ISO 27001.

Rhand holds an MBA in Business Management from Fundação Getúlio Vargas. Among his certifications are ISO 27001 Lead Auditor, ISO 9001 Lead Auditor, Certified Information Security Manager (CISM), Certified Information Systems Security Professional (CISSP), and others. He is a member of the ISACA Brasília Chapter.

You may unsubscribe at any time. For more information, please see our privacy notice.