Neven Zitek

Neven Zitek

February 25, 2014

Implementation, maintenance, training, and knowledge products for Information Security Management Systems (ISMS) according to the ISO 27001 standard.

Automate your ISMS implementation and maintenance with the Risk Register, Statement of Applicability, and wizards for all required documents.

All required policies, procedures, and forms to implement an ISMS according to ISO 27001.

Train your key people about ISO 27001 requirements and provide cybersecurity awareness training to all of your employees.

Accredited courses for individuals and security professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 and the ISMS using Advisera’s proprietary AI-powered knowledge base.

Compliance and training products for critical infrastructure organizations for the European Union’s Network and Information Systems cybersecurity directive.

All required policies, procedures, and forms to comply with the NIS 2 cybersecurity directive.

Company-wide training program for employees and senior management to comply with Article 20 of the NIS 2 cybersecurity directive.

Compliance and training products for financial entities for the European Union’s DORA regulation.

All required policies, procedures, and forms to comply with the DORA regulation.

Company-wide cybersecurity and resilience training program for all employees, to train them and raise awareness about ICT risk management.

Accredited courses for individuals and DORA professionals who want the highest-quality training and certification.

Compliance and training products for personal data protection according to the European Union’s General Data Protection Regulation.

All required policies, procedures, and forms to comply with the EU GDPR privacy regulation.

Train your key people about GDPR requirements to ensure awareness of data protection principles, privacy rights, and regulatory compliance.

Accredited courses for individuals and privacy professionals who want the highest-quality training and certification.

Implementation, training, and knowledge products for Quality Management Systems (QMS) according to the ISO 9001 standard.

All required policies, procedures, and forms to implement a QMS according to ISO 9001.

Accredited courses for individuals and quality professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 9001 and the QMS using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for Environmental Management Systems (EMS) according to the ISO 14001 standard.

All required policies, procedures, and forms to implement an EMS according to ISO 14001.

Accredited courses for individuals and environmental professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 14001 and the EMS using Advisera’s proprietary AI-powered knowledge base.

Implementation and training products for Occupational Health & Safety Management Systems (OHSMS) according to the ISO 45001 standard.

All required policies, procedures, and forms to implement an OHSMS according to ISO 45001.

Accredited courses for individuals and health & safety professionals who want the highest-quality training and certification.

Implementation and training products for medical device Quality Management Systems (QMS) according to the ISO 13485 standard.

All required policies, procedures, and forms to implement a medical device QMS according to ISO 13485.

Accredited courses for individuals and medical device professionals who want the highest-quality training and certification.

Compliance products for the European Union’s Medical Device Regulation.

All required policies, procedures, and forms to comply with the EU MDR.

Implementation products for Information Technology Service Management Systems (ITSMS) according to the ISO 20000 standard.

All required policies, procedures, and forms to implement an ITSMS according to ISO 20000.

Implementation products for Business Continuity Management Systems (BCMS) according to the ISO 22301 standard.

All required policies, procedures, and forms to implement a BCMS according to ISO 22301.

Implementation products for testing and calibration laboratories according to the ISO 17025 standard.

All required policies, procedures, and forms to implement ISO 17025 in a laboratory.

Implementation products for automotive Quality Management Systems (QMS) according to the IATF 16949 standard.

All required policies, procedures, and forms to implement an automotive QMS according to IATF 16949.

Implementation products for aerospace Quality Management Systems (QMS) according to the AS9100 standard.

All required policies, procedures, and forms to implement an aerospace QMS according to AS9100.

Implementation, maintenance, training, and knowledge products for consultancies.

Handle multiple ISO 27001 projects by automating repetitive tasks during ISMS implementation.

All required policies, procedures, and forms to implement various standards and regulations for your clients.

Grow your business by organizing cybersecurity and compliance training for your clients under your own brand using Advisera’s learning management system platform.

Accredited Lead Auditor and Lead Implementer courses for ISO standards and DORA, and an advanced course to help consultants grow their business.

Get instant answers to any questions related to ISO 27001 (ISMS), ISO 9001 (QMS), and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Find new clients, potential partners, and collaborators and meet a community of like-minded professionals locally and globally.

Implementation, maintenance, training, and knowledge products for the IT industry.

Automate your ISMS implementation and maintenance with the Risk Register, Statement of Applicability, and wizards for all required documents.

Documentation to comply with ISO 27001 (cybersecurity), ISO 22301 (business continuity), ISO 20000 (IT service management), GDPR (privacy), NIS 2 (critical infrastructure cybersecurity), and DORA (cybersecurity for financial sector).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and security professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 and the ISMS using Advisera’s proprietary AI-powered knowledge base.

Compliance, training, and knowledge products for essential and important organizations.

Documentation to comply with NIS 2 (cybersecurity), GDPR (privacy), ISO 27001 (cybersecurity), and ISO 22301 (business continuity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and security professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 and the ISMS using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for manufacturing companies.

Documentation to comply with ISO 9001 (quality), ISO 14001 (environmental), and ISO 45001 (health & safety), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 9001 (QMS) and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for transportation & distribution companies.

Documentation to comply with ISO 9001 (quality), ISO 14001 (environmental), and ISO 45001 (health & safety), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 9001 (QMS) and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for schools, universities, and other educational organizations.

Documentation to comply with ISO 27001 (cybersecurity), ISO 9001 (quality), and GDPR (privacy).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 (ISMS) and ISO 9001 (QMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, maintenance, training, and knowledge products for telecoms.

Automate your ISMS implementation and maintenance with the Risk Register, Statement of Applicability, and wizards for all required documents.

Documentation to comply with ISO 27001 (cybersecurity), ISO 22301 (business continuity), ISO 20000 (IT service management), GDPR (privacy), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and security professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 and the ISMS using Advisera’s proprietary AI-powered knowledge base.

Implementation, maintenance, training, and knowledge products for banks, insurance companies, and other financial organizations.

Automate your ISMS implementation and maintenance with the Risk Register, Statement of Applicability, and wizards for all required documents.

Documentation to comply with DORA (cybersecurity for financial sector), ISO 27001 (cybersecurity), ISO 22301 (business continuity), and GDPR (privacy).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and security professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 and the ISMS using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for local, regional, and national government entities.

Documentation to comply with ISO 27001 (cybersecurity), ISO 9001 (quality), GDPR (privacy), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 (ISMS) and ISO 9001 (QMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for hospitals and other health organizations.

Documentation to comply with ISO 27001 (cybersecurity), ISO 9001 (quality), ISO 14001 (environmental), ISO 45001 (health & safety), NIS 2 (critical infrastructure cybersecurity) and GDPR (privacy).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 (ISMS), ISO 9001 (QMS), and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for the medical device industry.

Documentation to comply with MDR and ISO 13485 (medical device), ISO 27001 (cybersecurity), ISO 9001 (quality), ISO 14001 (environmental), ISO 45001 (health & safety), NIS 2 (critical infrastructure cybersecurity) and GDPR (privacy).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 27001 (ISMS), ISO 9001 (QMS), and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for the aerospace industry.

Documentation to comply with AS9100 (aerospace), ISO 9001 (quality), ISO 14001 (environmental), and ISO 45001 (health & safety), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 9001 (QMS) and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for the automotive industry.

Documentation to comply with IATF 16949 (automotive), ISO 9001 (quality), ISO 14001 (environmental), and ISO 45001 (health & safety), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 9001 (QMS) and ISO 14001 (EMS) using Advisera’s proprietary AI-powered knowledge base.

Implementation, training, and knowledge products for laboratories.

Documentation to comply with ISO 17025 (testing and calibration laboratories), ISO 9001 (quality), and NIS 2 (critical infrastructure cybersecurity).

Company-wide cybersecurity awareness program for all employees, to decrease incidents and support a successful cybersecurity program.

Accredited courses for individuals and quality professionals who want the highest-quality training and certification.

Get instant answers to any questions related to ISO 9001 and the QMS using Advisera’s proprietary AI-powered knowledge base.

Neven Zitek

Neven Zitek

As a part of my job-related responsibilities, I’ve performed many IT due diligence analyses for customers, and one of the biggest problems I’ve encountered was identifying customers’ true IT costs. You’d imagine the process would be as simple as asking the finance department and acquiring accounting information, and you’d be right. But, the problems start once you get the answers:

“Servers……4pcs,” “Computer licenses……78pcs,” “Assorted IT equipment……7pcs.” Wait… what?

“There might be some more; however, if some (non-IT) department requested IT hardware / software, than it gets accounted for in their cost center, and we have no way of identifying it as IT-related cost.” This is the most typical answer I’d get.

If your organization handles the accounting of IT equipment in the same manner, I’m guessing you have your own, parallel system (or Excel sheet) in which you track IT and IT-related costs. I admit, even I had one of these at one point.

Accounting within ITIL Financial Management differs a lot from “traditional” accounting, in the sense that we need additional cost categories and characteristics defined in order to enable identification and tracking of service-oriented expenses. The result of the service-oriented accounting function is greater and more detailed understanding regarding service costs, which is extremely valuable for provisioning and consumption information, and planning.

In order to achieve effective IT accounting, you must be able to assign all cost entries to appropriate services. Depending on the services you provide, and their complexity, you’ll define appropriate granularity of the sub-service components. This task belongs to the Service recording function, which should be able to translate and assign costs to appropriate services or sub-services.

Some higher-level expense categories, known as Cost types, such as hardware, software, personnel, accommodation, etc., should be defined as well, as those attributes are valuable for reporting and analysis, and they are presented in commonly used financial terms.

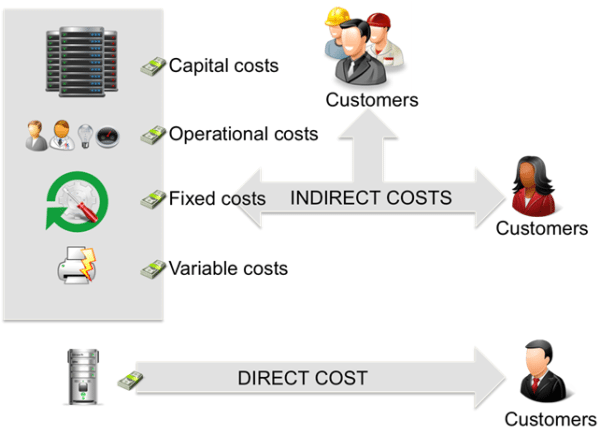

What you also need to understand are the Cost classifications – which designate the end purpose of the cost. As shown in Figure 1, we classify costs as:

Some like to present Cost classification as: Capital vs. Operational, Direct vs. Indirect, and Fixed vs. Variable, but personally, I believe that such presentation may be confusing, as it suggests that those classes exclude each other. In normal IT operation you have a fair mixture of cost classes; for example, the HR department will share indirect costs for networking service with the rest of the company, but will also receive direct cost regarding any specific service (e.g., extra server for HR software) exclusive to the HR department.

As IT accounting processes and practices mature and become service oriented, we gather more evidence about the performance of the IT organization. This information becomes visible through translating cost account data into service account information, enabling a higher level of service strategy development or execution.

You can start improving by asking yourself few simple questions: Is current accounting software capable of creating and managing needed subcategories and classes? Are current personnel capable of accurately recording IT-related costs? And, are you going to use the data as intended? From my experience, the most difficult and error-prone task was accurate recording of IT-related costs. You can try to solve this problem by improving the internal ordering process, so extra information about the cost type, class, service, etc. is recorded and matches the records in the accounting software. Of course, you could become an accountant yourself; I hear that accountants add up the telephone books for fun :).

To implement ISO 20000 easily and efficiently, use our ISO 20000 Documentation Toolkit that provides step-by-step guidance for full ISO 20000 compliance.

You may unsubscribe at any time. For more information please see our privacy notice.